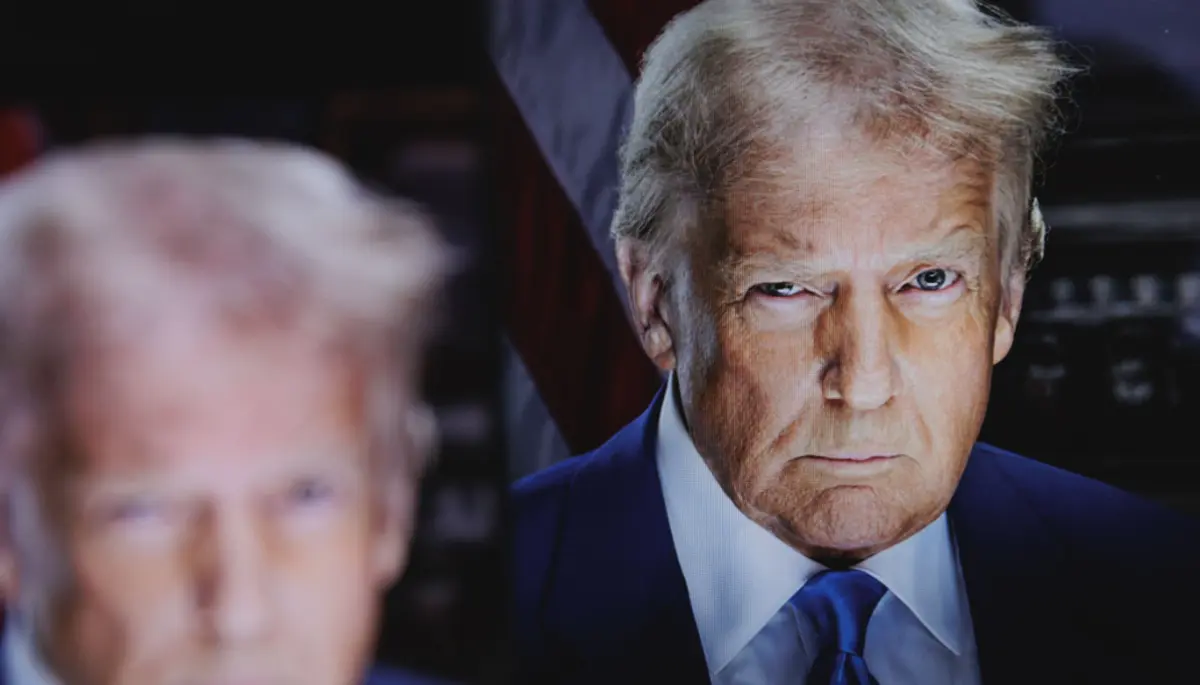

The recent decision by President Donald Trump to dissolve the National Cryptocurrency Enforcement Team, an initiative established by former President Joe Biden, sparks significant discussion about the future of cryptocurrency regulation in the United States. This move suggests a shift in focus towards combating financial activities linked to terrorism and drug trafficking rather than strictly enforcing regulations on cryptocurrency platforms. Critics argue that this decision could undermine efforts to ensure accountability and transparency within the cryptocurrency sector, potentially enabling illicit activities to flourish without proper oversight. As stakeholders await further clarity on regulatory approaches, many are concerned that trump disbands crypto enforcement team could lead to a more chaotic environment for digital currencies. Proponents of a relaxed regulatory framework, however, see this as an opportunity for innovation and growth in the blockchain industry.

Shifting Focus in Cryptocurrency Enforcement

Under Trump’s directive, the Department of Justice will continue to address financial crimes involving cryptocurrencies but will approach this issue from a new angle. Todd Blanche, the acting deputy attorney general, criticized the previous administration’s method as a “reckless strategy of regulation by prosecution.” He indicated that while the core mission remains intact—uncovering illicit cryptocurrency transactions—the tactics will now prioritize targeting the criminals directly rather than the exchanges and platforms they use.

The Broader Implications for the Crypto Community

This strategic pivot raises concerns among experts that illegal activities may occur more freely without stringent regulations on cryptocurrency exchanges. The former enforcement team, instrumental in high-profile cases like that of Avraham Eisenberg, helped to monitor and mitigate risks associated with market manipulation and fraud within the cryptocurrency market, highlighting the risks of loosening regulatory oversight.

Trump’s Personal Investment in Cryptocurrency

It’s important to note that Trump’s administration is not merely focused on regulation; the President himself has vested interests in the cryptocurrency space. Both Trump and First Lady Melania Trump have launched their own cryptocurrency, which faced scrutiny when its value dropped significantly post-launch. Furthermore, the Trump family is involved with the World Liberty Financial (WLF) project aimed at creating a stablecoin, indicating a personal financial interest in the crypto sector.

The SEC’s Evolving Role

The restructuring of the U.S. Securities and Exchange Commission under Trump’s leadership is another aspect influencing the cryptocurrency landscape. The SEC has historically taken a strict stance against cryptocurrency projects, as seen in notable litigation against Ripple. However, the current leadership appears to be more amenable, having dropped several lawsuits, which could benefit the broader crypto community by reducing regulatory burdens.

Conclusion: A Mixed Outlook for Cryptocurrency in the U.S.

As Trump continues to advocate for a more relaxed regulatory environment in an effort to position the U. S. as a global leader in cryptocurrency, the implications for enforcement and fraud prevention remain unclear. While easing regulations can spur innovation and investment in the crypto market, it poses challenges for maintaining security and trust within the financial system. This development captures the tension between fostering economic growth and protecting consumers, a balancing act that will be closely watched as the landscape evolves. Furthermore, critics argue that without robust regulatory frameworks, the potential for fraud and market manipulation could increase, endangering both individual investors and the overall economy. As stakeholders from various sectors weigh the pros and cons of such an approach, the long-term effects of the Trump crypto policy changes will be crucial in shaping the future of this burgeoning industry. Ultimately, finding a middle ground that supports innovation while ensuring consumer protection will be essential for sustainable growth in the cryptocurrency market.