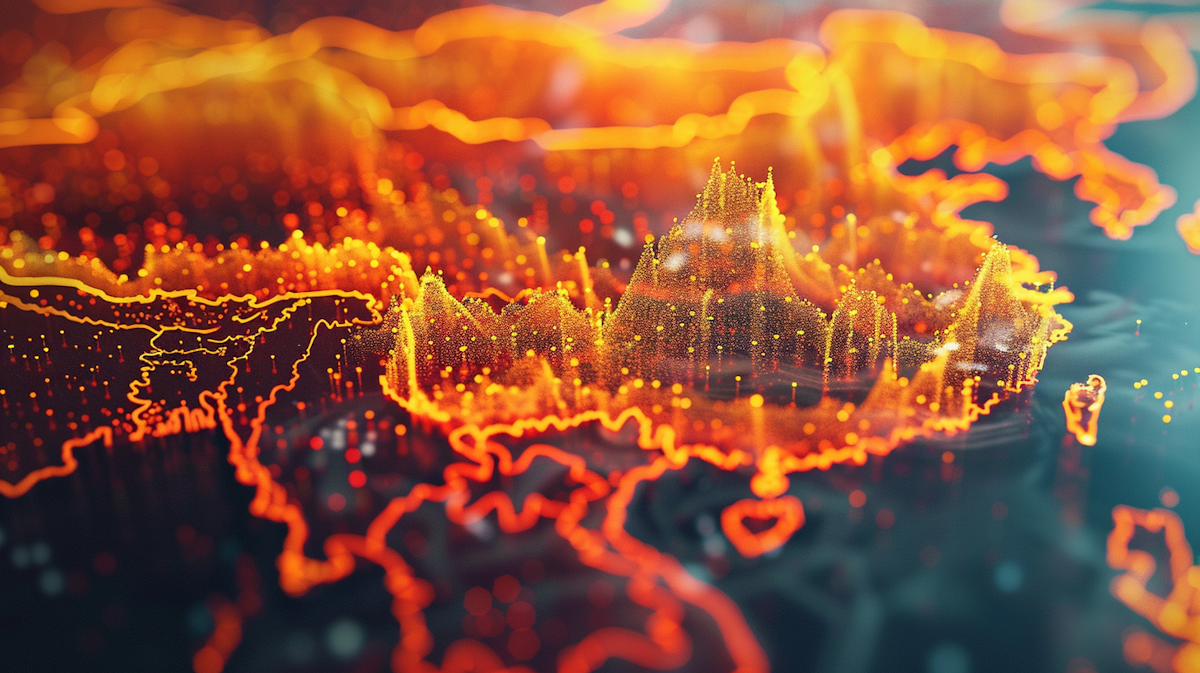

In the realm of cryptocurrency, China finds itself at a crossroads as local authorities grapple with a substantial accumulation of digital assets. Since the ban on cryptocurrency trading in 2021, local governments have been left with considerable amounts of confiscated digital currencies, including Bitcoin, raising questions about the future of these assets and their potential impact on public finances. Authorities are now exploring potential strategies for managing these digital assets, with some advocating for a cautious re-evaluation of their stance on cryptocurrency. China’s approach to crypto assets will likely reflect broader economic goals, as officials consider whether to leverage these holdings for innovation or to freeze them indefinitely. The implications of these decisions could reverberate through the global market, influencing investor sentiment and regulatory frameworks worldwide.

Understanding the Landscape of Confiscated Cryptocurrency

In an effort to curb illegal financial activities, the Chinese government, via its central bank, implemented a prohibition on cryptocurrency transactions in September 2021. This decision has made all interactions with digital currencies, such as Bitcoin, illegal. As a result, local governments are now holding a significant stockpile of confiscated cryptocurrencies, which they are unable to liquidate under current regulations.

The Dilemma of Local Governments

Faced with often tight budget constraints, local authorities are keen to access the financial benefits that could come from selling these seized digital currencies. The reality, however, is that the existing ban complicates potential sales. Reportedly, local governments have sought to sidestep the legal restrictions by engaging private companies to facilitate these transactions covertly. As professor Chen Shi from Zhongnan University for Economics and Law notes, these practices function as a desperate measure amid the lack of clear regulatory guidance.

Growing Calls for Regulatory Changes

Recent discussions among higher-level judges and police officials suggest a potential adjustment to the ban could be on the horizon. According to Reuters, the idea of legally allowing the sale of confiscated cryptocurrencies is under serious consideration, indicating a shift toward a more flexible regulatory approach. This would enable local governments to monetize these assets legally, thus enhancing their budgets and enabling better local governance.

China’s Position in the Global Cryptocurrency Market

China is noteworthy on the global cryptocurrency stage as it ranks as the second-largest holder of Bitcoin, trailing only behind the United States. Reports indicate that as of the end of last year, Chinese local governments possessed approximately 15,000 Bitcoin, a significant portion of the estimated total 190,000 Bitcoin owned by the country, valued at roughly $15.8 billion. This digital treasure chest, which also likely includes billions in alternative cryptocurrencies, presents an opportunity for economic advantage if managed effectively.

The Path Forward: Challenges and Opportunities

The central question remains not if China will tap into this vast reserve of digital currency, but when and under what conditions. The future of the cryptocurrency landscape in China holds critical implications not only for local governments but also for the broader international market. With ongoing debates surrounding regulation and enforcement, stakeholders must prepare for a potentially transformative phase in the management of digital assets within the country.

As discussions continue, the evolution of regulations will be crucial in shaping how these assets can be utilized and possibly reintegrated into the economy—marking a significant shift for China in its approach to cryptocurrency.