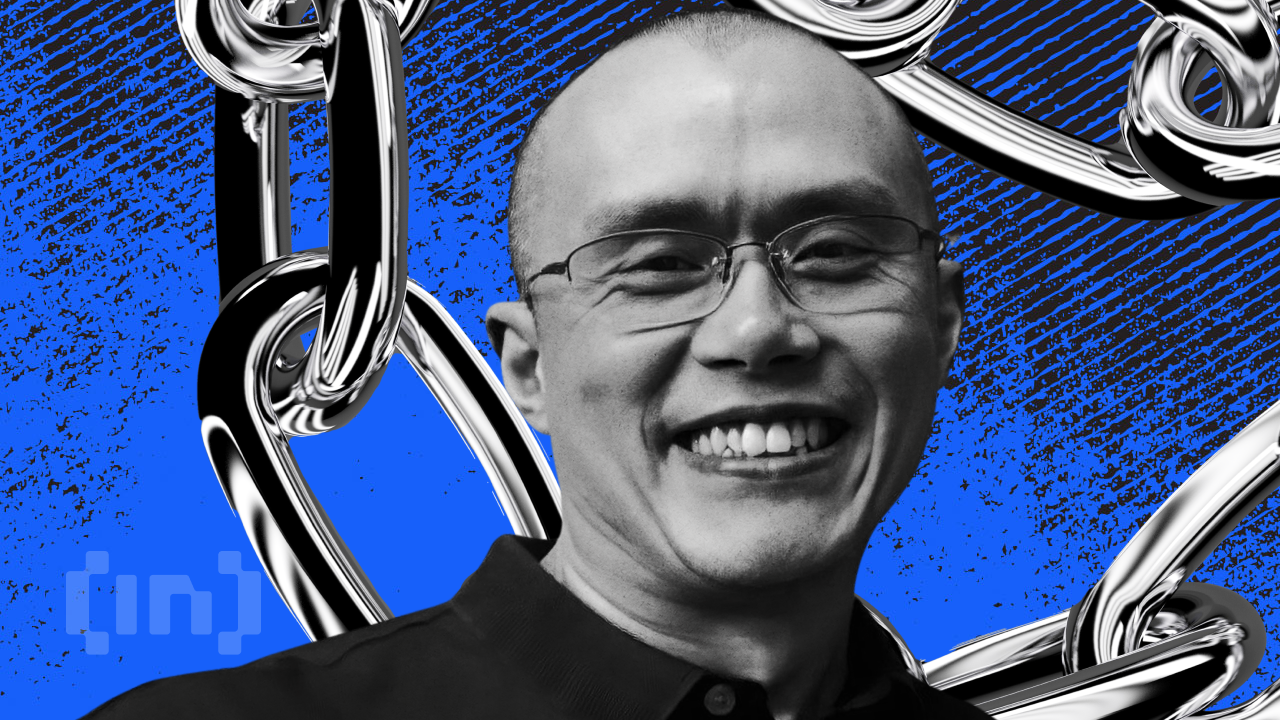

In the world of cryptocurrency, a significant development is brewing that could have far-reaching implications for both the market and regulatory landscape. Recent speculation suggests that former President Donald Trump may consider granting a presidential pardon to Changpeng “CZ” Zhao, the founding figure behind the cryptocurrency exchange Binance. While no formal decision has been made, the discussions within the White House indicate a divided opinion on the matter among senior advisors, raising questions about the broader impact of such a pardon.

Potential Outcomes of a Presidential Pardon

If granted, the pardon would erase the federal conviction that Zhao received after pleading guilty to violating the Bank Secrecy Act in 2023, due to insufficient anti-money laundering measures while leading Binance. This legal relief would not only remove the criminal record but could also restore his eligibility to engage with U.S. financial institutions, freeing him from the constraints of previously imposed penalties.

Despite having served a four-month sentence and paying a hefty $50 million fine for his infractions, Zhao’s conviction still imposes limitations on his ability to operate freely within the U.S. financial markets. A pardon would effectively clear his name, allowing him to explore new ventures or re-engage with the cryptocurrency sector as an investor or advisor.

Implications for the Crypto Community

The broader implications of a pardon for Zhao extend beyond his individual circumstances. It brings to light ongoing tensions between cryptocurrency innovation and regulatory enforcement. Currently, Binance faces scrutiny from regulators, with the U.S. government previously accusing the exchange of enabling transactions that bypassed sanctions and compliance checks. A pardon for Zhao could reignite debates about accountability in the cryptocurrency sector and the fine line between innovation and compliance.

Regulatory Concerns and Market Reactions

While the idea of Zhao returning to the U.S. market attracts interest, it does not come without complications. Even with a pardon, separate regulatory agreements may prevent him from holding an executive role at Binance for a number of years. This situation raises concerns about how Zhao’s potential return might trigger closer scrutiny from U.S. regulators, especially given the existing apprehension regarding Binance’s compliance protocols.

Community Perspectives

The discussions surrounding Trump’s possible pardon for Zhao have sparked a wave of reactions from across the cryptocurrency community. Proponents argue that clearing Zhao’s record could pave the way for new opportunities in the U.S. crypto market, allowing for increased innovation and potential collaborations that were previously hindered by legal restrictions. In contrast, critics warn that such a move might send a troubling message about the consequences of financial misconduct.

Final Thoughts

As the narrative around Zhao’s situation unfolds, it is clear that any decision made could have a ripple effect throughout the cryptocurrency ecosystem. The ongoing deliberations between the White House and regulatory bodies pose key questions about how America shapes its financial future in the face of evolving cryptocurrency practices. With the attention of the financial world focused on this potential pardon, the stakes for both Zhao and the crypto market are undeniably high.