The landscape of financial regulations in the United States is witnessing a significant transformation, especially concerning cryptocurrencies. This shift is primarily driven by a new leadership at the Securities and Exchange Commission (SEC), which is essential for overseeing the financial markets. The SEC’s evolving stance is a reflection of changing attitudes towards digital assets, particularly in relation to retirement savings.

New Leadership at the SEC Signals Change

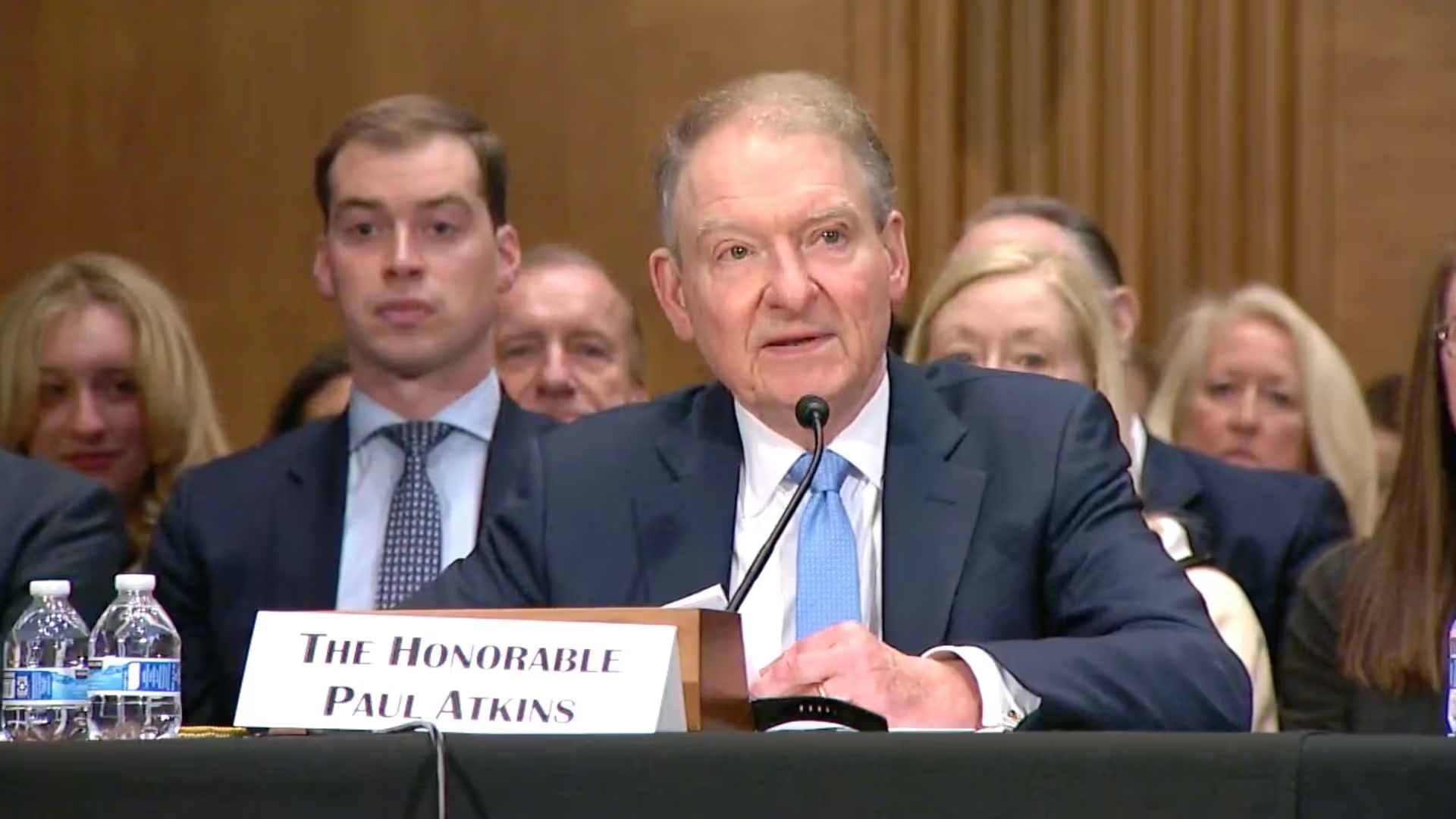

Historically, the SEC has played a crucial role in regulating cryptocurrencies, often taking a stringent approach. Until recently, under the chairmanship of Gary Gensler, the SEC was known for its tough stance against the crypto industry, even bringing legal actions against major firms like Coinbase and Ripple. However, this perspective took a turn when Paul Atkins was appointed as the new SEC chairman. Atkins has emerged as a prominent advocate for digital assets since the re-election of Donald Trump, who voiced ongoing support for cryptocurrencies during his campaign.

The Potential Impact on Retirement Funds

In an insightful interview with CNBC, Atkins put forth a groundbreaking suggestion: the need to open the American pension market to cryptocurrencies, specifically allowing direct investments through 401K plans. This proposal could unlock access to digital currencies for millions of Americans, enabling them to invest in Bitcoin and other cryptocurrencies as a part of their retirement savings.

Market Implications of Opening 401K Plans

The 401K market is substantial, valued at approximately $12.5 trillion. Even a small allocation of this capital into cryptocurrencies could have profound effects on the digital asset market, potentially driving prices higher and attracting new investors. Atkins’ statement is poised to capture the attention of crypto investors and industry stakeholders alike, as it underscores a pivotal change in how large segments of the population might soon engage with cryptocurrencies.

A Broader Trend in Financial Inclusion

This proposed shift towards including cryptocurrencies in retirement savings highlights a larger trend of financial inclusion, where access to new forms of investment is being democratized. For many individuals, the possibility of integrating digital currencies into their long-term financial planning represents an important step in adapting to modern investment opportunities. This change also reflects a broader acceptance of cryptocurrencies in mainstream financial practices.

In conclusion, the SEC’s modified approach under Chairman Paul Atkins not only represents a pragmatic shift in regulatory attitudes but also indicates a potential renaissance for cryptocurrencies in traditional financial landscapes, particularly in retirement planning. As the situation develops, the changes in policy could herald a new era of investment options for American savers.