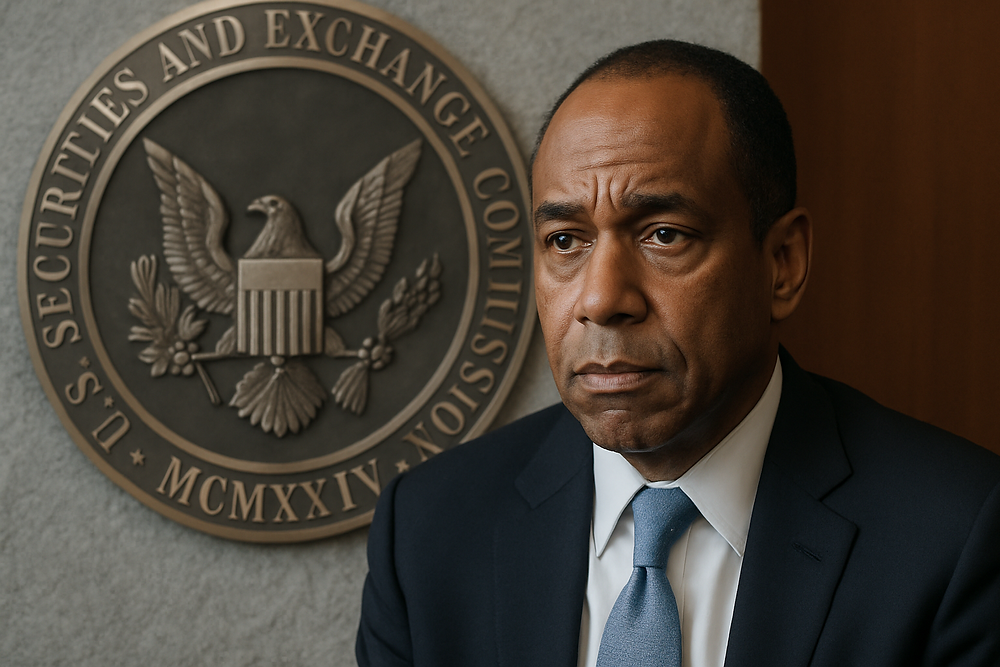

The evolving landscape of cryptocurrency regulation in the United States is experiencing a pivotal moment, as the chair of the Securities and Exchange Commission (SEC), Paul Atkins, proposes significant reforms aimed at fostering innovation while protecting investors. The proposal was made clear during the Federal Reserve Bank of Philadelphia’s annual Fintech Conference, where Atkins outlined his vision for a tailored regulatory framework around crypto-assets.

Creating a Supportive Environment for Blockchain Projects

Atkins’ approach involves the introduction of a package of exemptions designed to ease the compliance burden on blockchain startups. This initiative seeks to facilitate capital formation by simplifying how crypto assets can be offered, especially for projects aligned with investment contracts. Such changes could empower smaller firms to focus on technological advancements rather than navigating a convoluted legal environment.

Importance of Token Classification

A central aspect of the proposed regulations is the establishment of a clear taxonomy for digital tokens. Atkins emphasized that not all tokens should be considered securities. Categories that would not fall under securities laws include:

- Digital commodities

- Network tokens, used as fuel for blockchain operations

- Digital collectibles, such as non-fungible tokens (NFTs) that serve primarily for collection

- Digital utility tokens, which could provide access to services or memberships

This taxonomy serves an essential function for both investors and developers by clarifying legal obligations and protecting consumer rights, thus creating a more robust framework for innovation.

Securing Trust Amid Easing Regulations

While the proposed reforms are encouraging, Atkins acknowledged the continuing necessity for stringent regulation to combat fraud within the growing retail investor market. He reassured that increased flexibility in the regulatory framework would not equate to lax enforcement, indicating a balanced approach to oversight.

Collaborative Regulatory Efforts

The SEC’s initiatives will not occur in isolation. Atkins highlighted the importance of collaboration with other regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) and banks, to formulate a comprehensive regulatory regime that spans multiple jurisdictions, encompassing financial laws, consumer protection, and anti-money laundering rules.

Future Prospects for U.S. Cryptocurrency Regulation

As the nation turned its attention to the establishment of a legislative framework by the year’s end, Atkins called for a unified regulatory approach that could stabilize the landscape for various digital assets. The health of the cryptocurrency market remains contingent on the trust of its users, the strength of the underlying technology, and the vision driving these projects.

Final Observations

Atkins’ push for streamlined regulations highlights the need for innovation-friendly conditions without compromising investor security. The forthcoming months, during which Congress will deliberate on market structure legislation, will be critical in shaping the future of cryptocurrency in the U.S. With the right balance, the potential for a vibrant ecosystem prioritizing both innovation and oversight could emerge.