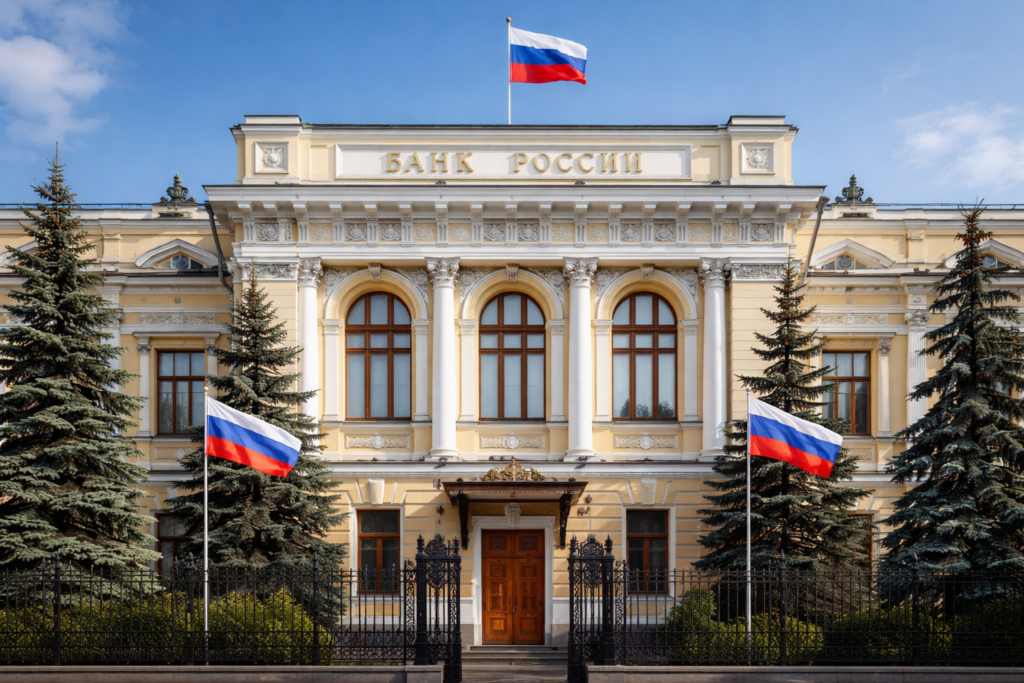

The landscape of cryptocurrency in Russia is on the verge of a significant transformation. The Bank of Russia has proposed a regulatory framework that could potentially open the doors for citizens to invest in cryptocurrencies, albeit with strict safeguards in place.

Proposed Regulatory Framework Overview

On December 23, the Bank of Russia revealed plans to regulate access to cryptocurrencies, allowing both qualified and non-qualified investors to acquire crypto assets. However, each group will be subject to distinct regulations aimed at protecting individual investors.

The proposed system aims to be finalized by July 1, 2026, and is currently under review by the government. This initiative represents a turning point in the Russian approach to digital currencies, reflecting an eagerness to create a safer investment environment while navigating the complexities of international sanctions.

Impact on Non-Qualified Investors

The proposed rules will introduce specific limitations for non-qualified investors, who include average citizens. These individuals will have access only to a select list of liquid cryptocurrencies, which has yet to be specified. A yearly purchase cap of 300,000 rubles (approximately $3,843) has been suggested, alongside a requirement to pass a knowledge test before purchasing any crypto. This is designed to ensure that everyday investors fully understand the risks associated with cryptocurrency investments.

Considerations for Qualified Investors

For qualified investors, the scenario looks more favorable. They will reportedly have access to a wider range of cryptocurrencies, although privacy coins will still face restrictions due to their ongoing challenges in various jurisdictions. Even these investors will be required to undergo a knowledge assessment to ensure they are aware of potential risks.

External Exchanges and Taxation Implications

Russian citizens may also be permitted to purchase cryptocurrencies on foreign exchanges via international accounts. In such cases, investors would need to inform local tax authorities about these transactions, fostering transparency but also placing the onus of reporting on the investors themselves.

Bank of Russia’s Cautious Stance

Despite the Bank of Russia’s willingness to allow controlled access to cryptocurrencies, the institution remains skeptical about their overall value. It warns that cryptocurrencies are high-risk instruments, lacking formal backing and fraught with volatility and potential sanction risks.

Historically, the Bank has maintained an anti-cryptocurrency position, initially proposing an outright ban. However, as economic pressures mounted due to heightened sanctions, the bank reassessed its approach.

Recent Developments in Cryptocurrency Regulation

Last year marked a turning point as the Bank of Russia agreed to legalize cryptocurrencies for foreign trade settlements. This coincided with a newly established framework allowing commercial banks limited involvement in crypto-related activities. Furthermore, with Russia’s energy surplus, the country has also begun presenting cryptocurrency mining as a legitimate export product, integrating it further into the economy.

As the proposed regulation moves through the approval process, it is poised to significantly impact the investment landscape in Russia, balancing between the desire to provide opportunities for citizens and the need for careful oversight and risk management.