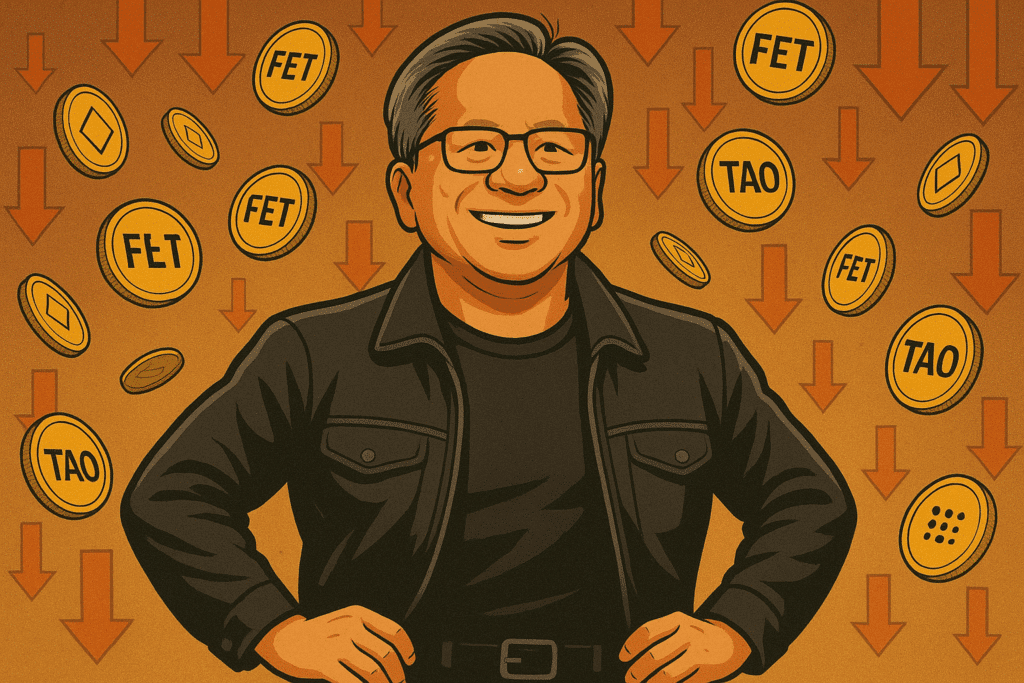

Crypto Tokens Decline Amid Nvidia’s Surge: An Industry Perspective

The cryptocurrency landscape is witnessing a concerning trend, as many AI-focused tokens experience significant drops in value while traditional tech stocks, particularly Nvidia, soar to unprecedented heights. This divergence has left analysts reflecting on the broader implications for the crypto market, especially as AI continues to reshape the technological frontier.

The Rise of Nvidia and Tech Stocks

Nvidia Corporation, a leading graphics processing unit (GPU) manufacturer, recently achieved a record stock price of $155.45. This marks a strong recovery following a challenging start to 2025, which included a notable drop of 37.6% earlier in the year. Factors contributing to this volatility included competition from Chinese tech firms and regulatory tariffs that raised concerns about the company’s market access.

Difficult Days for Crypto AI Tokens

In stark contrast, major cryptocurrency tokens that claim to harness AI technology—such as Bittensor (TAO) and Fetch.ai (FET)—are grappling with declines of over 20%. This is particularly alarming since the hype surrounding AI tech last year had initially driven their prices up significantly. The current downturn raises questions about the valuation of such tokens and their true market demand.

Economic Implications for the Community

The ramifications of these market trends extend beyond financial metrics; they impact the perception of cryptocurrencies within the broader economic landscape. According to Ram Ahluwalia, CEO of Lumida Wealth, the surge and subsequent fall of AI tokens highlight an essential issue: the lack of viable products that generate real revenue. This calls into question the sustainability and future growth of these projects.

Industry Insights: A Possible Turnaround?

Despite the current bleak outlook, some experts argue this situation could be temporary. Zach Pandl, head of research at Grayscale Investments, believes that the disconnect between traditional equity markets and decentralized AI projects may relate more to capital availability than underlying project fundamentals. He suggests that growth opportunities still exist within decentralized AI, where innovative projects like Bittensor are slowly gaining traction.

Challenges for Emerging Players

The situation has become particularly critical for emerging companies like Interactive Strength (TRNR), which recently announced a significant investment plan focused on acquiring FET tokens. Unfortunately, their timing coincided with the sharp decline in token values, resulting in TRNR’s stock price tumbling by over 53% since their announcement.

Looking Ahead: Bitcoin’s Continued Dominance

As AI-centered tokens encounter turbulence, Bitcoin remains a stronghold, accounting for 65.91% of the total cryptocurrency market capitalization. This statistic not only displays Bitcoin’s dominance but also suggests that investors may be seeking refuge in more established assets during this turbulent period.

In summary, the contrasting fortunes of Nvidia and AI crypto tokens serve as a reflection of larger trends within both technology and finance. The community will be keenly observing how these dynamics evolve and whether innovative projects can regain momentum in a world increasingly driven by AI. As the market continues to shift, it becomes vital for stakeholders to adapt and identify sustainable growth avenues.