The recent drop in Chainlink’s LINK-token has captured the attention of the cryptocurrency community, highlighting the challenges and volatility surrounding digital assets. This significant decline raises questions regarding the underlying factors impacting investor sentiment and market dynamics.

Market Reactions and Trading Trends

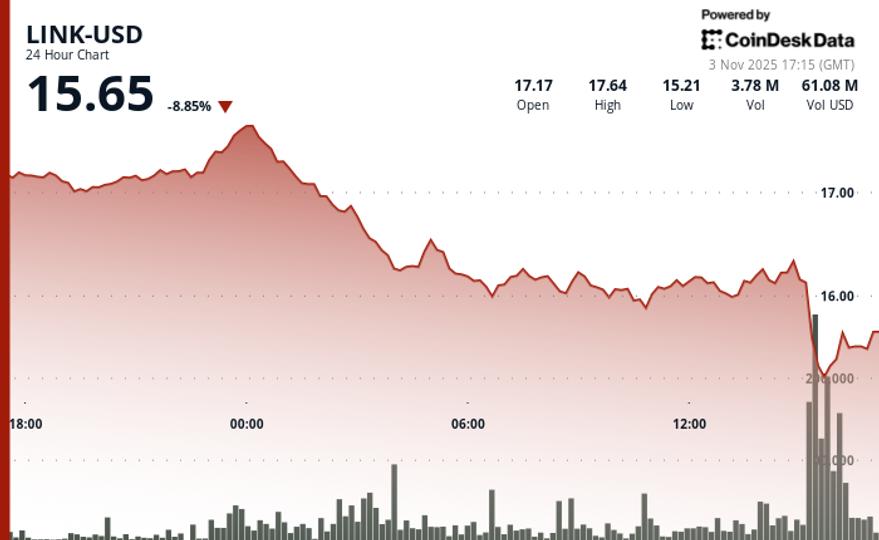

On Monday, the LINK-token experienced a sharp decline of 10%, reaching its lowest point since a notable market crash on October 10. The asset fell from $16.21 to $15.02 within a mere 30-minute window. This swift drop was accompanied by a staggering 674% surge in trading activity, with more than 12 million tokens changing hands during this period, as reported by CoinDesk Research.

Importance of Technical Levels

Investors are paying close attention to crucial support levels. The technical model indicates that LINK now faces essential support around $15.25. If the price cannot maintain this level, it may be vulnerable to dropping further to approximately $14.50. In contrast, resistance is observed near $17.66, making these thresholds critical for traders.

Rewards Program Launching Soon

This decline coincided with Chainlink’s announcement of “Rewards Season 1,” set to begin on November 11. The program provides eligible LINK stakers an opportunity to earn token rewards by participating in various Chainlink BUILD projects. Notable projects include Dolomite and Space and Time, as mentioned in the company’s blog post.

Future Implications for Investors

Participants in the rewards program can earn non-transferable points, referred to as Cubes, which can be allocated to their preferred projects based on prior staking activity. The rewards from these activities are expected to start rolling out in mid-December, offering some potential benefits for investors despite the recent market turbulence.

Conclusion: A Landscape in Flux

This recent downturn reflects broader trends in the cryptocurrency market, underscoring a period of increased volatility. As LINK faces significant technical challenges and a changing market landscape, the response from participants in the upcoming rewards program may play a crucial role in shaping the future of both the token and investor confidence. Insight into these dynamics could offer valuable perspectives for stakeholders navigating this evolving environment.