Market Volatility Impacts Crypto Lending Services

In a significant move reflecting the ongoing turmoil in the cryptocurrency market, BlockFills, a Chicago-based lending platform, has suspended both client withdrawals and deposits. This decision comes as a response to recent market instability that has raised concerns across institutional crypto services, as reported by the Financial Times.

Suspension of Fund Movements

BlockFills, which has been a critical player in the cryptocurrency community, processing a staggering $60 billion in trading volumes in 2025, took this action last week. While clients are barred from moving funds, they can still engage in trading activities, including opening and closing positions in both spot and derivatives markets, according to company statements.

Protective Measures for Clients

A spokesperson from BlockFills explained the rationale behind this temporary suspension: “In light of recent market and financial conditions, and to further the protection of clients and the firm, BlockFills took the action last week of temporarily suspending client deposits and withdrawals.”

Institutional Client Base

Approximately 2,000 institutional clients, including cryptocurrency-focused hedge funds and asset managers, utilize BlockFills as a liquidity provider and lender. Notably, access to the platform’s options products is restricted to investors holding a minimum of $10 million in digital assets.

Historical Parallels

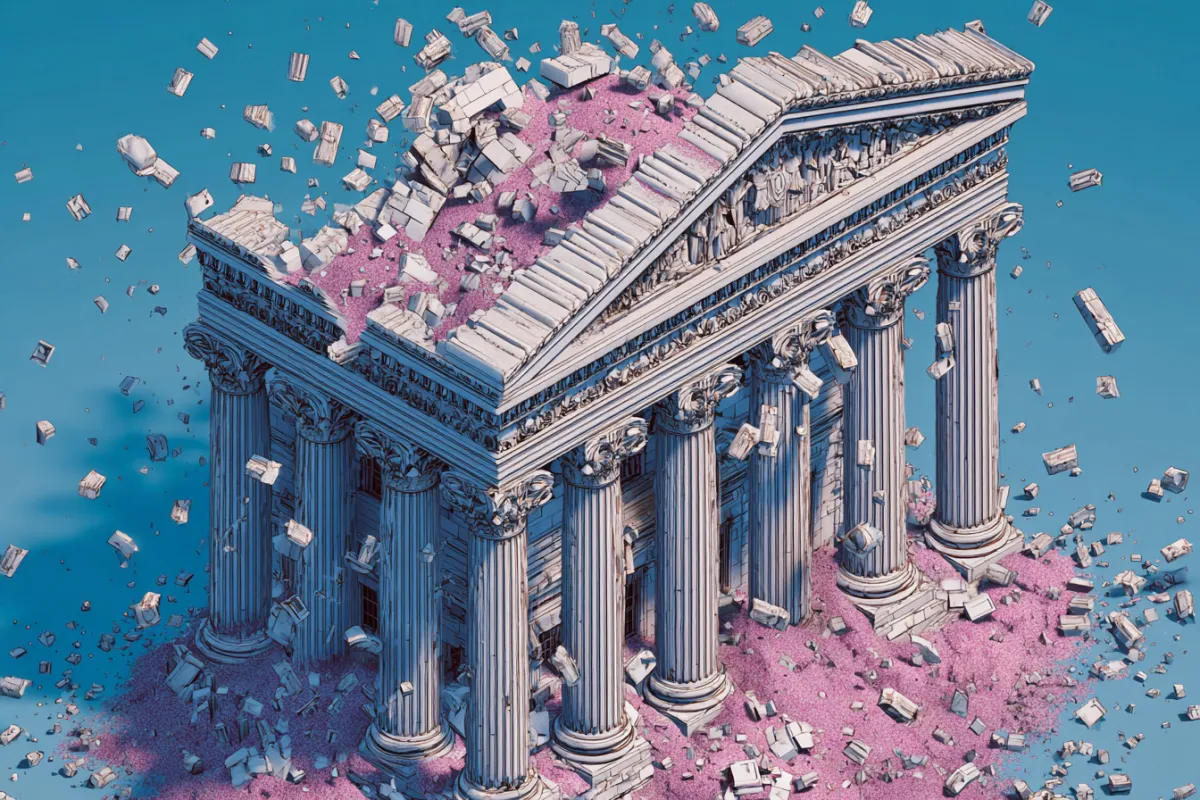

This move mirrors actions taken during the 2022 downturn in the cryptocurrency market, where multiple lending platforms also froze client funds amid financial distress. Such incidents culminated in the notorious collapse of the crypto exchange FTX, emphasizing how volatile market conditions can lead to widespread repercussions.

Investor Support and Future Steps

BlockFills is reportedly in discussions with investors and clients to address the situation and restore liquidity to the platform. Among its key investors are Susquehanna Private Equity Investments and CME Ventures, though neither has issued comments regarding the current restrictions.

Bitcoin’s Decline and Market Conditions

The withdrawal suspension is closely associated with recent declines in Bitcoin prices, which fell below $65,000 for the first time since 2024. This decline, approximately 25% year-to-date and nearly 45% from its peak of nearly $125,000 in October 2025, indicates a broader market trend impacting investor confidence.

Looking Ahead

The cryptocurrency market was buoyed by optimism following Donald Trump’s presidential election victory last year, with expectations of favorable regulatory changes. However, increasing market volatility and tariff threats have since reversed this trend, leading to significant selloffs and liquidations. BlockFills, founded in 2018, has been a prominent player in the market, expanding its institutional offerings during bullish periods. As it navigates this challenging landscape, stakeholders will be watching closely for updates on liquidity recovery and operational stability.