Understanding the modern investment landscape is increasingly crucial for individuals, especially those from traditional backgrounds. In this context, Bitcoin is emerging not just as a cryptocurrency but as an innovative alternative to conventional real estate investments.

The Shift to Digital Investments

For years, many investors have relied heavily on tangible assets, such as real estate, believing they are a foolproof way to secure wealth. However, as the economic landscape changes, the rise of digital assets like Bitcoin is prompting a reevaluation of these traditional beliefs.

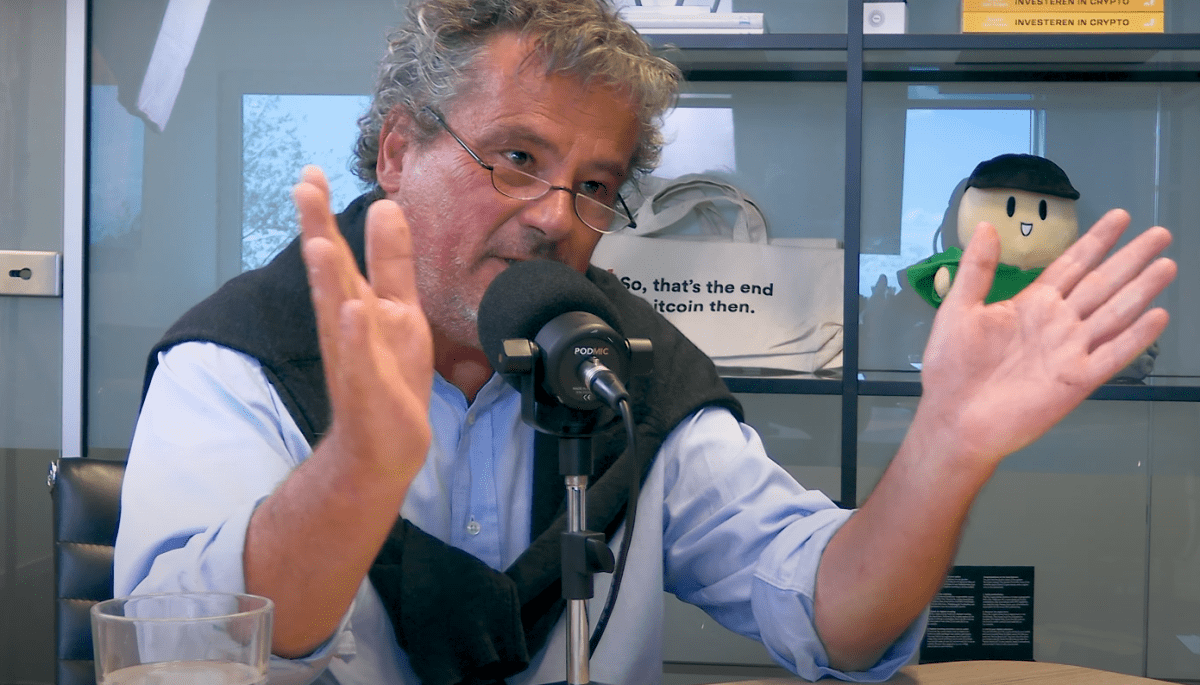

Recently, a seasoned real estate expert acknowledged a staggering portfolio worth 1.5 billion in property transactions over a 35-year career. This experience has led to a critical realization: the value of property is not solely in the building itself, but rather in the potential of the tenant. Without reliable income from tenants, real estate can become burdensome.

Challenges of Property Management

Managing real estate requires continuous investment, from maintenance to taxes, which adds to the complexity and stress of being a property owner. Investors must navigate issues like fluctuating market conditions and regulatory challenges that can dramatically impact their profitability. Events or policies enacted by governmental figures can quickly change the dynamics of the investment landscape.

On the other hand, Bitcoin, often referred to as “digital real estate,” offers a hands-off approach. While it lacks a direct rental income, its value can appreciate significantly over time, compensating for the absence of cash flow from traditional investments. This innovative asset transcends geographical boundaries, providing investors with flexibility and ease of access.

Benefits of a Digital Approach

Without the constant oversight and expenses associated with physical properties, Bitcoin offers a new way to engage with investments. It acts like virtual property you can carry in your pocket, allowing for portability and reduced management hassles. This aspect becomes particularly appealing as investors seek safer havens for their investments, free from the uncertainties that can plague conventional real estate.

Moreover, Bitcoin’s digital nature enables investors to react quickly to changing personal circumstances or market conditions, unlike traditional property, which requires more lengthy transactions.

A New Perspective on Wealth

This evolving view on investment is crucial as it reflects a broader trend toward digital financial assets. More individuals, especially those who are not digital natives, are beginning to understand the potential of cryptocurrencies as a viable alternative to traditional real estate.

As awareness of cryptocurrencies grows, the conversations surrounding them become more relevant, urging both seasoned and curious investors to explore smarter, more flexible ways to build and protect their wealth.

For those interested in deepening their understanding of these modern investment vehicles, exploring platforms that discuss Bitcoin is essential. By doing so, individuals can stay informed and engaged with the rapidly evolving financial landscape.