In the world of cryptocurrency, market fluctuations often stir a mix of anxiety and opportunity among investors. Recently, Bitcoin experienced a significant downturn, raising eyebrows and fears within the community regarding its future trajectory.

A Week of Volatility for Bitcoin

Last Monday night, Bitcoin’s price peaked at approximately $95,400. However, within just four hours, it plunged by about $3,000, leaving investors uneasy. By midnight on Tuesday, the cryptocurrency closed at $88,400, marking a notable drop that highlighted the erratic nature of digital currencies.

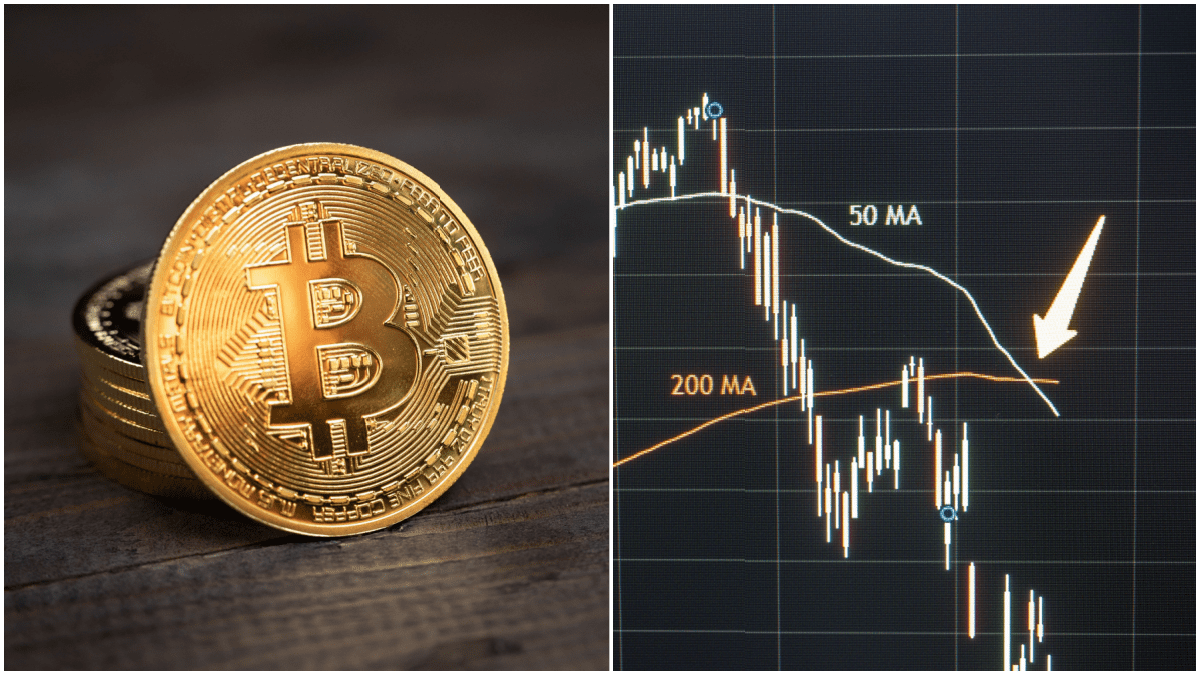

Understanding the “Death Cross”

On Thursday evening, a crucial finding was shared by the account of Crypto Crew University. They observed a “death cross” pattern emerging. This phenomenon occurs when the 50-day moving average crosses below the 200-day moving average, signaling a short-term downtrend that can lead to more substantial declines. Such patterns have historically indicated significant market corrections, with previous occurrences in 2014, 2018, and 2022 resulting in substantial drops of 50% to 70% in Bitcoin’s value.

Community Insights and Diverging Opinions

The cryptocurrency community is rife with differing opinions about Bitcoin’s near-term future. While some analysts express caution due to the “death cross,” others, like a different expert on social media, report a “rising wedge” formation in Bitcoin’s price chart over the years. According to this perspective, if Bitcoin’s price hits the lower boundary of this pattern, it could bounce back, sustaining the established support and resistance lines.

Market Sentiment: Hope and Uncertainty

Despite the pessimistic forecasts surrounding Bitcoin, a survey conducted on the betting platform Kalshi reveals that around 50% of participants believe Bitcoin could breach the $100,000 mark by April. This division in sentiment reflects the broader uncertainties and hopes within the crypto landscape.

The Importance of Upcoming Trends

The implications of Bitcoin’s price movements extend beyond mere numbers; they resonate deeply within the financial community and can influence wider market trends. With increasing volatility, individual traders and institutional investors alike must navigate this uncertain terrain, remaining vigilant for both risks and potential opportunities.

In conclusion, as analysts continue to scrutinize Bitcoin’s market patterns, the forthcoming days promise to be crucial for those involved in cryptocurrency trading. The tension between hope and caution is palpable, signaling an evolving narrative in the realm of digital currencies.