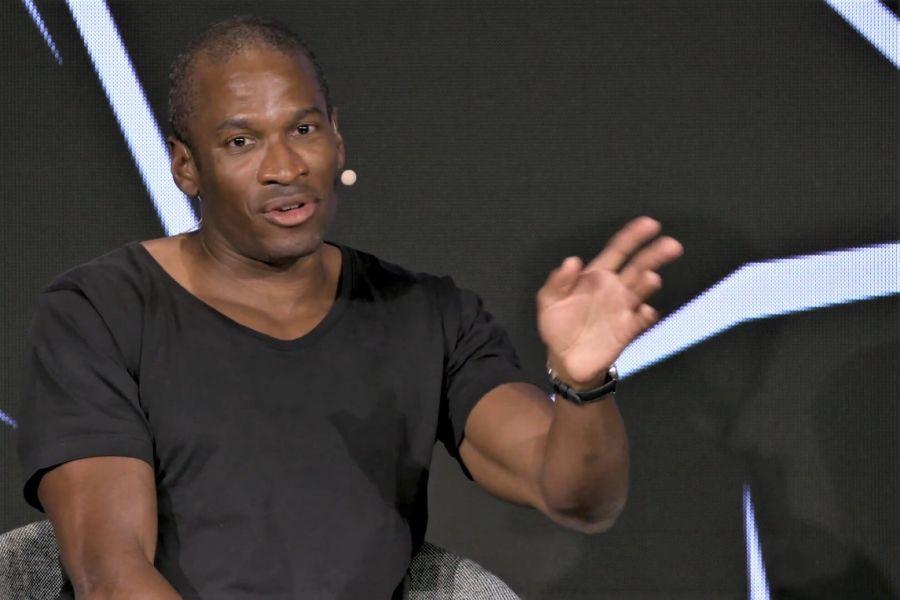

Crypto enthusiasts are currently feeling an air of optimism, closely monitoring predictions made by Arthur Hayes, the co-founder of BitMEX. Recent statements hint at an approaching turnaround in the cryptocurrency market, signaling a potential resurgence that experts believe could reinvigorate investor confidence.

Market Liquidity and the Treasury General Account

Hayes emphasizes that the nearing conclusion of the Treasury General Account (TGA) replenishment plays a crucial role in the upcoming bullish trends. He notes that this account, which represents the U.S. Treasury’s general payment account at the Federal Reserve, is close to hitting its target of $850 billion. The replenishing of the TGA typically withdraws money from the banking system, resulting in decreased liquidity. Thus, when this process is complete, a financial environment with greater liquidity could emerge, benefitting cryptocurrencies like Bitcoin.

The Impact of Federal Policy on Crypto

The anticipation surrounding Hayes’s prediction is rooted in broader economic expectations, particularly the monetary strategies likely to be employed by the current administration. Earlier this month, Hayes articulated that a substantial phase of cryptocurrency growth is on the horizon, especially with potential financial policies that could be spearheaded by President Trump. He suggests that Trump’s historical willingness to distribute “free money” could serve as a catalyst for increased money flow into the economy, a tactic Hayes forecasts will be reused leading up to the elections in 2026 and 2028.

Implications for Investors

If Hayes’s predictions prove accurate, the influx of capital could create favorable conditions for high-risk assets, particularly Bitcoin and other leading cryptocurrencies. Bitcoin, often regarded as a digital store of value, stands to gain significantly during times of increased money circulation initiated by central banks. An expected surge in liquidity could provide substantial momentum to Bitcoin’s price and other cryptocurrencies, marking the potential commencement of a new bullish era.

Community Response and Market Sentiment

This dialogue around the impact of liquidity on the cryptocurrency market aligns with sentiments shared among a growing number of investors. Many believe that the relationship between U.S. liquidity and cryptocurrency performance is a key indicator of market health. As the pressure in money markets eases, it may signal the onset of a fresh growth phase in digital assets. Observers are now questioning whether this predicted resurgence will indeed materialize, encouraging traders and investors alike to prepare for possible market shifts.

As anticipation builds, the cryptocurrency community remains divided—while some are embracing the possibility of a prolonged bullish phase, others remain cautious. Will the forthcoming adjustments in monetary policy indeed pave the way for renewed expansion in the cryptocurrency space? The answer remains uncertain, but optimism continues to ripple through the digital asset landscape.